Help Protect Your Financial Wellness with Comprehensive Wealth Strategies

We understand the unique financial challenges faced by medical professionals. Our knowledgeable team provides tailored strategies for every stage of your financial journey—from retirement strategies to legacy building and beyond.

Our Services

Financial Strategies

The Consortium of Professional Providers (CPP) has transitioned from Financial Strategies to Wealth Strategies. While financial blueprints typically focus on specific goals like budgeting and retirement saving, CPP emphasizes a holistic approach with Wealth Strategies that encompass complex investments, legacy strategies, and tax optimization.

Wealth Management

Wealth management blends art and science with the goal of growing and protecting your wealth. CPP brings together financial advisors, accountants, and attorneys to provide comprehensive strategies. Our platform includes public and private investments, offering access to private equity through partnerships with leading money managers at lower minimums.

Proactive Tax Strategies

Some CPAs do little more than record history; they are simply focused on putting the right number in the right boxes. However, there is a big difference between tax preparation vs. tax strategy.

College Strategies

Our college tuition professionals can help you decide the right path forward to ensure your children and grandchildren receive the education they’re seeking as cost-effectively as possible.

Legacy and Legal Strategies

Both traditional estate and legacy involve managing assets after death. However, legacy strategies take a broader approach and consider not only financial assets but also intangible values, personal impact, and the overall legacy you want to leave behind. Whereas traditional estate strategies primarily focus on the legal distribution of tangible assets like property and money.

Insurance and Risk Mitigation

One of the greatest risks to wealth accumulation for many retirees may be long-term health care and litigation. Risk mitigation is a focus of the Consortium of Professional Providers who use long-term care insurance, umbrella insurance, or other related tools.

Business Advisory Services

Consortium of Professional Providers business advisory firms can help reduce the stress of running your business. Everything from back-office support to entity type analysis, accounting system setup, retirement analysis, and more.

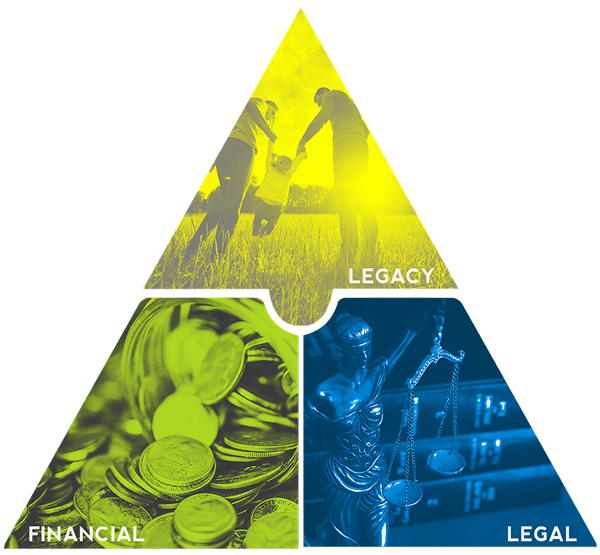

The Legacy Pyramid

The CPP program is comprised of 3 components:

- Financial Component

- Legal Component

- Legacy Component

The Financial Component

The Financial Component is divided into the following two areas:

1. Financial Information

- Financial and informational videos on demand

- Webinars

- E-Newsletters

- Monthly mentoring calls

2. Financial Empowerment

- 1on1 coaching (ongoing available and recommended)

- Financial 2nd opinions

- Access to industry professionals (tax, legal, financial)

- Design(holistic, specific, comprehensive)

- Implementation

The Legal Component

- Litigation protection

- Asset protection Strategies

- Probate protection Techniques

- Tax reduction (help protect from excess taxes)

- Strategies to help protect against stock market losses

- Strategies to help protect against long-term care costs

- Help protect 403(b)s, 457s and IRAs from excess taxes upon death

*No financial or estate plan is considered complete by the CPP without incorporating asset protection

Legacy Component

What do the successful do differently? Achieving multi-generational unity and prosperity is not just the result of doing good financial and estate strategies. Instead, lasting success comes about because they add an essential third element to their strategy, one that has come to be known as the Family Values Component of the Legacy Pyramid.

Despite the infinite number of characteristics that distinguish one family from another, we believe that the things that most parents want to pass on to their children share a lot in common. It is a basic human desire to pass not just what we have (our assets) but also who we are (our stories, values, life lessons, and experiences).

We Can Help Protect Your Financial Wellness

Our coaching programs provide personalized guidance designed to enhance your financial well-being. We offer tiered levels of support, ranging from foundational guidance and assessments to comprehensive strategy development and implementation, helping you protect assets, minimize taxes, and achieve your long-term financial goals.